case study

Mi-Pay

The Next Generation of Payment Fraud Detection

Where we started

![]()

Blue Hat supported Mi-Pay to extend their fraud detection engine to create a stand alone product.

AIM listed Mi-Pay is a European e-commerce payment, risk management and digital CRM solution provider delivering simple, risk free solutions to complex and ever-changing payment challenges with many blue chip relationships.

Mi-Pay processes over £100m pa in fully managed payment services and £50m in payment fraud solutions. Mi-Pay has developed its own in-house technology and solutions layered on top of traditional payment partners.

Blue Hat is assisting Mi-Pay on an on-going basis in reviewing the current platform and supporting the business and technology teams in defining the product roadmap and delivering the next generation of the fraud detection platform.

“Blue Hat offered the flexibility and willingness to understand our requirements and factor those challenges into their review, not simply consult and produce a report.”

John Beale, Mi-Pay CEO

“Blue Hat have been very open and honest regarding their own skill sets and ability to bring all our resources on board with the journey. They have a broad range of skills - the technology skills that we would expect, but also a strong commerical understanding and subject matter expertise in payment processing.”

John Beale, Mi-Pay CEO

How BlueHat delivered change

![]()

The Brief

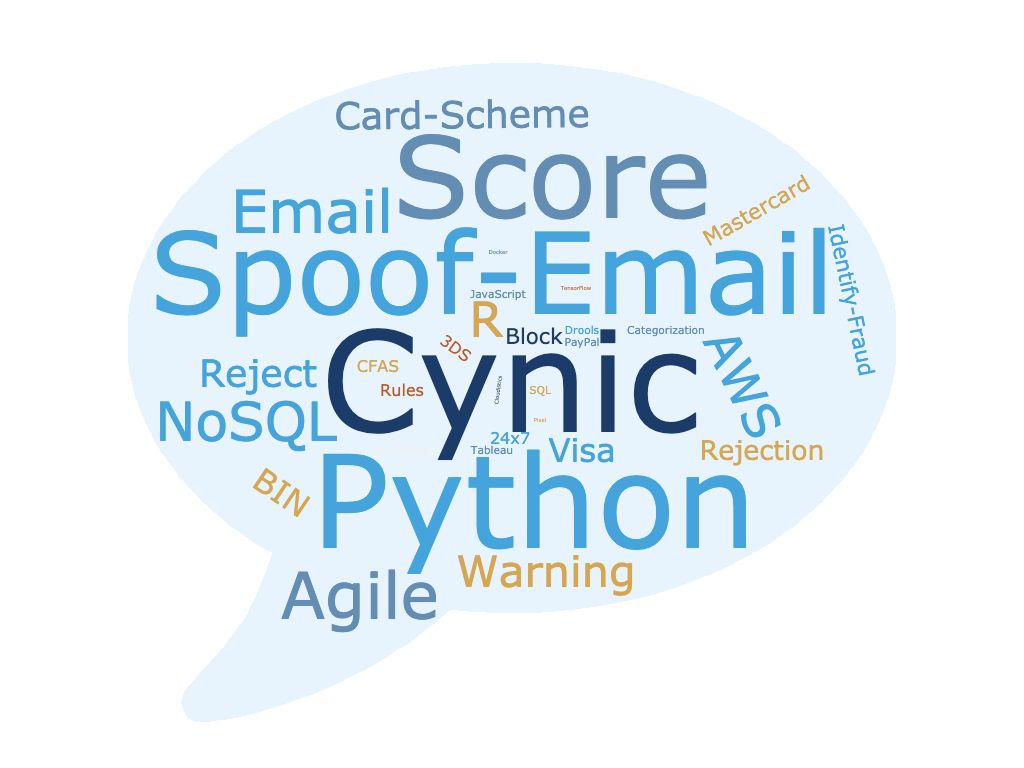

Mi-Pay’s hugely successful Cynic platform was developed to reduce fraud as part of their payments processing business. The platform is used to process over £150m of payments annually. Cynic achieves industry leading fraud detection levels.

The business had grown organically with the fraud service integrated to their payment processing business. However the management team wanted to explore commercial opportunites of offering their fraud service as a stand-alone bolt on to e-commerce businesses.

Mi-Pay approached Blue Hat to lead and provide an independent review of the current platform and identify areas of operations and technical functionality that could be extended.

The Approach

Blue Hat worked with the management team, the fraud operations team, the data scientists and the technology team.

It was an exciting project, and the Mi-Pay team were extremely motivated to find a mix of new technologies to enhance the product offering and support growth.

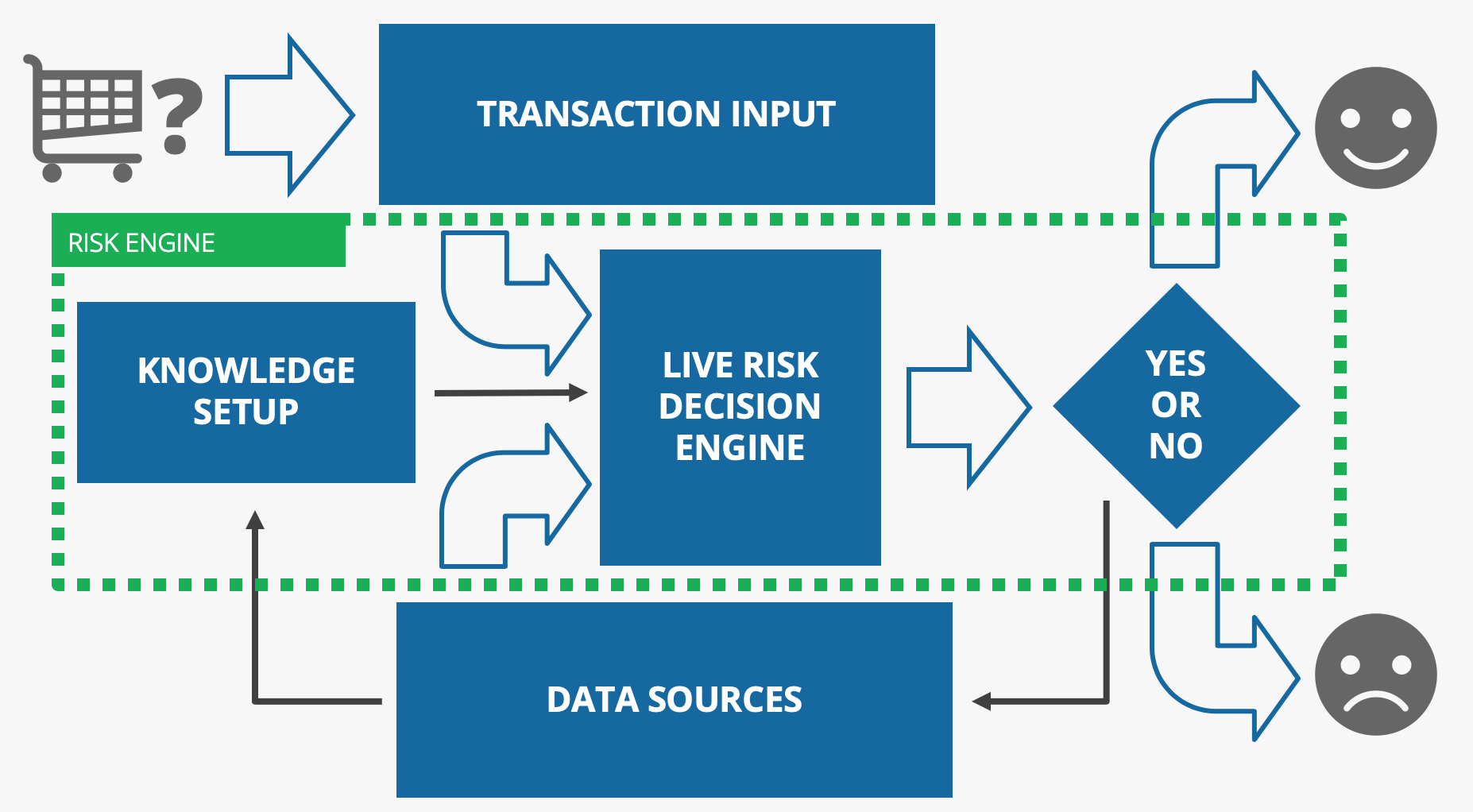

We reviewed the existing technical architecture and daily processes, and from this we collaborated on production of a new Target Operating Model in combination with a Logical Architecture "Straw Man".

Blue Hat worked with the management team, risk operations, data science and technology divisions of Mi-Pay to understand the current payment fraud detection process.

With the team, we identified a number of extensions where there was opportunity for operational improvements and commercial opportunities for extension.

We also worked on the innovation of Cynic version 2 – a platform combining rules, machine learning and e-commerce tracking technology.

The Solution

![]()

We presented the new Target Operating Model for to extend the business. We looked at the commercial opportunities to offer indemnified fraud to new customers, and designed a test-and-learn approach to run the Cynic platform in new sectors.

Working with the Risk Team we developed new dashboard technology to improve the team’s real time identification of new risk factors.

Blue Hat continue to work with Mi-Pay in supporting their transformation for the launch of the Cynic V2 fraud detection system.

We are delighted to be implementing a truely innovative Rules Engine and Machine Learning approach to e-commerce flows.

Fast Agile: From Whiteboard to Launch in 12 Weeks

Company: Borrow A Boat

We had 12 weeks to launch a new omni-channel offering for Borrow A Boat in time with their summer marketing campaign.